Please rotate your screen for best viewing experience

Press

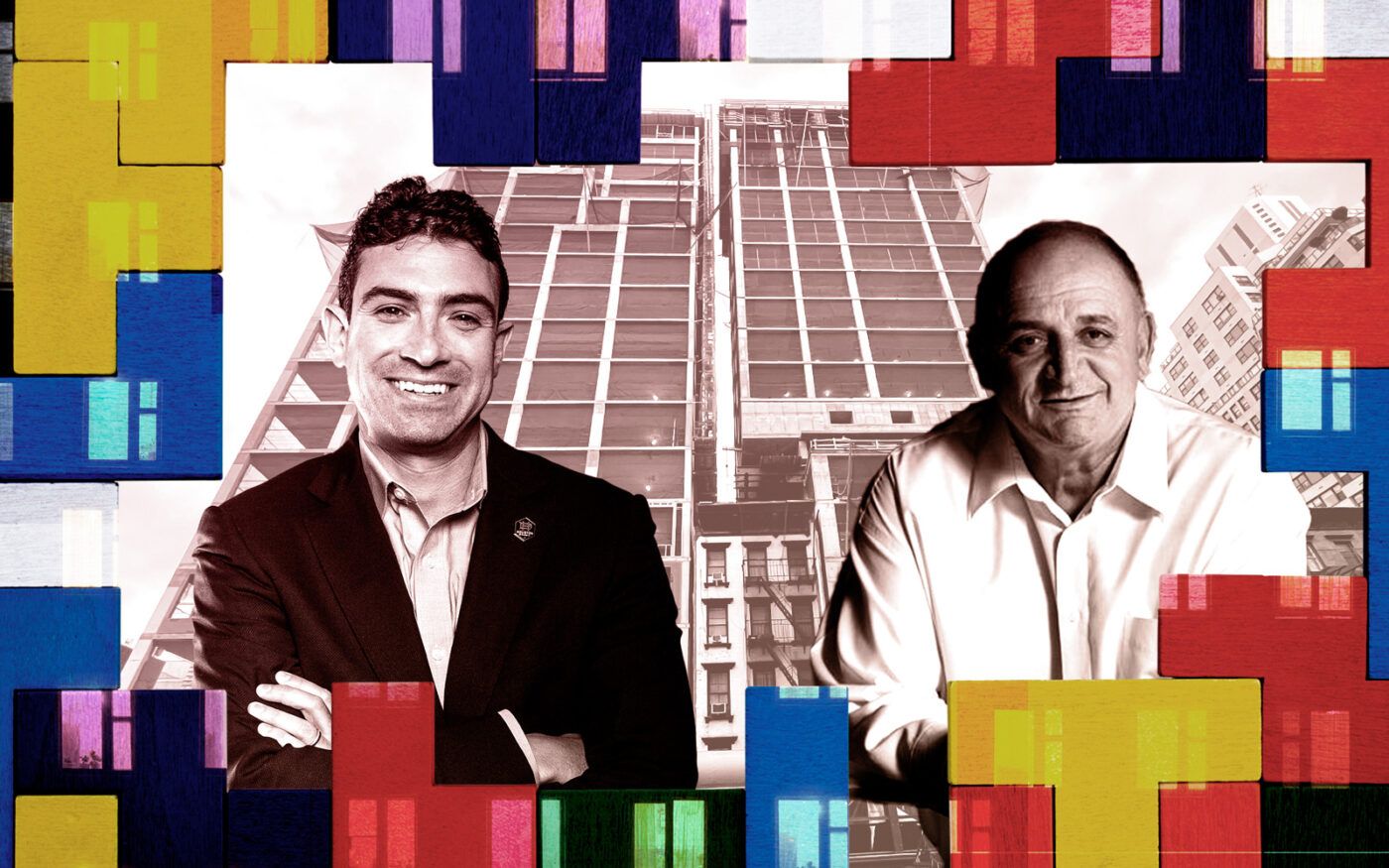

ON THIRD AVENUE, A GAME OF REAL ESTATE TETRIS

Two developers are playing a real estate version of Tetris on the Upper East Side.

Their projects have enveloped a small, 110-year-old apartment building that stubbornly clung to its Third Avenue foothold.

On one side of the walk-up, Ted Segal’s EJS Development is building 36 condo units at 200 East 75th Street, vaulting 18 stories straight up. It just landed $112.5 million in construction financing from Bank OZK.

Feet away, literally wrapped around its pre-war neighbor, a 33-story tower by Isaac Tshuva’s El Ad Group is rising at 1299 Third Avenue.

200 East 75th Street and 1299 Third Avenue (Orion Jones)

The four-story walk-up sandwiched between them has the government to thank for its survival. A thicket of zoning rules and tenant protections resulted in the visually striking, if not particularly efficient, development around it.

To avoid the political gauntlet of the city’s rezoning process, EJS and El Ad pieced together smaller properties so each could build one big one. EJS assembled the land for its project in 2021 for a combined $32 million, or $330 per buildable square foot.

Segal, EJS’ founder and owner of two Houston soccer teams, opted to build 36 condos instead of a possible 144 rental units because the 421a tax abatement for rental projects expired, the New York Times reported. The story noted that the development will result in a net loss of apartments.

EJS had paid out of pocket to construct the East 75th Street building until it recently topped out, which made lenders willing to offer better financing terms. The senior loan provided by Bank OZK was $84.5 million.

El Ad bought its project site, an assemblage created by four air rights deals and three mergers of land parcels, from Premier Equities in 2022 for $61 million, or $440 per buildable square foot. The firm received $100 million from Valley National Bank in May to begin construction.

For tall, narrow buildings like El Ad’s, air rights transfers and zoning mergers help circumvent the city’s sliver law, a height limit on skinny buildings. Some have blamed the obscure measure for contributing to New York’s housing shortage.

“Without the sliver law, you could create 90,000 additional apartments,” said Frank Chaney, a land use attorney at the law firm Rosenberg & Estis. “The idea was to keep heights in context, but now it has the reverse effect of requiring smaller buildings on the block” surrounded by taller ones.

The small apartment building tucked between EJS and El Ad’s projects could hardly look more out of place. El Ad used air rights to build a cantilever over it.

The cantilever makes El Ad’s development lot wider, averting the sliver law, but it also entombs the small walk-up building, making it harder to maintain. A crane can no longer operate above it, and its aging mechanical systems could deteriorate. The building was constructed in 1910 and refurbished in 1988, according to city records.

For El Ad, which did not respond to a request for comment, having to build around the century-old walk-up made its project costlier and more complicated.

Premier Equities might have simplified matters in 2018, when it bought the air rights to the small apartment building for $5.8 million, by buying the building itself and knocking it down. However, several rent-stabilized units in the building may have made that less palatable, if not impractical.

Rent-stabilized tenants are entitled to lease renewals indefinitely if they stay current on rent, and can bequeath that right to an heir. If all tenants do not agree to buyouts, the landlord could have to wait many decades to demolish a building.

Even negotiating buyouts is a fraught process. A relatively new law, written to prevent harassment, requires landlords to put their offers in writing and to wait 180 days between making offers. Landlords who don’t take “no” for an answer can face legal consequences.

“It can be easier to sell air rights and cantilever a building,” said Chaney, “than the cost of buying [tenants] out. There’s a simple cost-benefit analysis. It’s not always worth the cost of buying people out.”

The owner of the walk-up building that sold air rights to Premier later capitalized on the building itself, selling it to middle-market investor Elliot Sohayegh in 2022 for $4.9 million. He did not answer an inquiry for this story.

Aside from selling its air rights, Sohayegh’s building did aid the adjacent development in another way. One tenant occupying space on EJS’s site moved into a market-rate unit in the walk-up, according to the developer. And Triton Construction, the contractor on the condo project, is using the building’s retail space as its construction office.